As spring has officially started last week, employees might start evaluating alternative mobility options to get to work. For employees that live close to work, an (electric) bicycle commute to work, for instance, could be an attractive alternative in fine spring weather. As an active commute mode is beneficial for the employee well-being, it makes sense for employers to encourage such mobility choices. But are alternative mobility options also beneficial for the employer, from a financial point of view?

In this blog, we define alternative mobility as commute modes alternative to the (company) car, referring to public transport (train, transit), cycling, walking and combinations of those. Quite often, they are referred to as sustainable mobility options, because of the reduced carbon emissions compared to moving by traditional combustion engine cars. Apart from the environmental benefits, alternative modes are reportedly beneficial for the employees’ health. For instance, train passengers are generally more physically active and less overweight than car drivers, according to a Dutch study [1]. Furthermore, cycling to work reduces absenteeism. The more days per week, and the longer the commute, the larger the positive effect, likely primarily through health effect or through satisfaction effect [2]. Finally, commuting satisfaction increases job performance. Shorter (duration) commutes and active travel (especially among middle-aged employees) increases commuter satisfaction [3]. The impact on performance is likely to be indirectly through the happiness effect.

Regulatory provisions in Belgium

As we know from corporate cars, the journey between the place of residence and the place of work is considered a private journey for the employee. Therefore, if the employer grants allowances for these journeys, these allowances are not considered to be costs caused by the exercise of the professional activity on behalf of the employer or the legal person, but as specific allowances. To stimulate the use, and thus the positive effects of alternative commute modes, policy makers have exempted these allowances from tax to incentivise alternative mode adoption. For bicycles, allowances up to 0.24 EUR/km granted by an employer to the employee are exempt from income tax and social security contributions[4]. Note that “bicycle” refers to any bicycle, motor-powered bicycle or motor-powered speedpedelec: city bikes, electric bikes, cargo bikes. A collective labour agreement can further specify regulations. For instance, PC-200, the sector federation that represents approximately 1/3rd of employees in Belgium (500k employees), decided that from 1/7/2022 onwards, a regular user of a bicycle for commuting purposes will be granted a bicycle allowance of 0.20 EUR/km with a maximum of 8 EUR per working day [5], a doubling compared to 0.10 EUR/km with a maximum of 4 EUR made compulsory in 2020. Finally, cost incurred or borne for the establishment and/or for the encouragement of commuting by (electric) bicycle, such as employee facilities, are tax deductible at 100%.

In terms of public transport, the policy makers make a distinction between train and public transport other than the train. For both types however, the intervention of the employer is mandatory by law [6]. The subscription costs are 100% deductible, and only 6% of VAT applies, which is fully recoverable. Within PC-200, the contribution of the employer to the price of the train ticket used is equal to 80% of the price of the 2nd class rail card for a corresponding distance. Furthermore, the companies are recommended to conclude a third-party payer arrangement for train transport with the NMBS at no additional cost, with the remaining 20% being borne by the government, so that the employee can enjoy free commuting by train (PC-200, Art. 3.§1, and §2).

For other transit, two scenarios apply [7]:

- When the price of transport is proportional to the distance, the employer’s contribution is that provided for the train but limited to 75% of the actual price of transport.

- When the price of transport is determined irrespective of distance, an allowance of 71.8% of the real transport price is applied, but limited to the allowance provided for the train for a distance of up to 7 kilometres.

For more information on regulatory aspects, this link [8] provides an extensive overview.

Employer costs

As has become clear in previous paragraphs, employers [9] are confronted with legal obligations regarding the (private) work-home journey. However, for employees that receive a company car from the employer, the employer is no longer obliged to contribute to the commuting expenses. However, it is also not prohibited. The employer can therefore allow the employee to keep his company car and still contribute to (part of) the costs of a train ticket, or pay a bicycle allowance for days on which the employee commutes to work in an alternative way. This alternative travel cost remains free of social security contributions and taxes. The question thus arises: Should employers take on the additional cost for alternative mobility, on top of the company car? The question whether employers that provide company cars should contribute to the costs of alternative mobility, from a financial point of view, boils down to two sub-questions: (1) what is the cost of alternative mobility, and (2) how much do avoided company car kilometres bring in terms of savings [10].

Car costs reduction

If kilometres driven by alternative modes replace kilometres driven by the company car, car savings should emerge. The obvious first source of savings is the variable energy cost: costs for fuel and/or electricity. Due to recent energy price hikes, this cost has grown significantly for employers. Note that differences in powertrains are present, with petrol and diesel cars to be most costly in terms of energy, respectively.

Additionally, less kilometres mean a higher residual value of the car, and thus a lower operational lease price. For operational lease contracts, a lease matrix can be requested that shows the impact on the monthly lease price for different contract mileages (and contract durations).

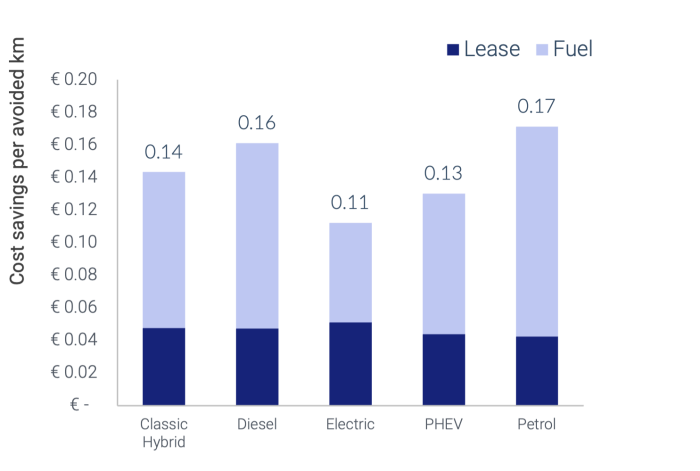

Figure 1 depicts the cost savings per avoided kilometre, per powertrain. Note that a small number of company cars were taken from our LIF database to arrive at these averages, and these numbers should not be regarded as representative for the Belgian corporate fleet. For more information on how the after-tax costs of company cars is calculated at LIF, we refer you to our blog on TCO [11].

Figure 1: Incremental cost per kilometer per powertrain

Alternative mode costs

Costs for Cycling

In this section, we’ll assume no additional cycling incentives, such as providing company bikes or contributing to the costs of the lease bike in the cafeteria plan. As outlined in the section on regulatory provisions in Belgium, the costs for cycling are thus straightforward: maximally 24 cents per kilometre, and at least 20 cents for PC200 employees as of this summer. Assuming 24 cents, the after-tax cost (100% deductible, 25% tax rate) is 18 cents/kilometre. Taking into account the kilometre savings for cars in Figure 1, it is clear that the cost savings from the replaced car kilometres do not fully outweigh the kilometre allowance.

Costs for Rail

The NMBS offers different products, which are more suitable depending on both the frequency, and the distance of the commute.

Occasional use:

- Single tickets

- 10 (same) journey pass

- Railease: 20, 40 of 60 travel days within one year. Starting at 13.55 EUR per day, one day’s travel allows unlimited travel over the whole NMBS/SNCB network.

Frequent use:

- Half-time journey pass: same journey 2-3 times per week

- Standard season ticket (1, 3, 12 months)

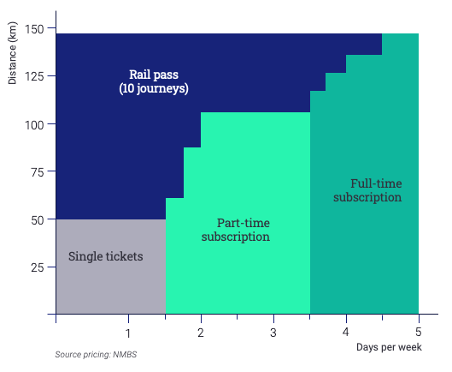

Figure 2 depicts the optimal product in terms of cost for combinations of distance and frequency.

Figure 2: Optimal NMBS offering in terms of distance and frequency

Note that NMBS is working on more flexible NMBS products. Currently, a pilot project with flexible home to work passes is running, that allows to select days more freely:

- 80 or 120 days per year

- or 6 or 10 days of your choice per month

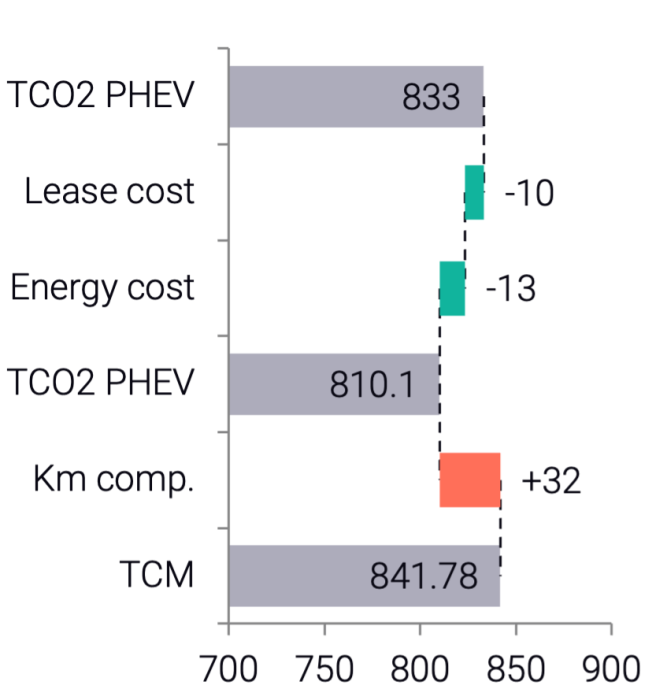

Shift to e-bike example

Consider an employee that wants to e-bike to work for two days per week. She normally drives a VOLVO XC40 (most popular lease car in Belgium [12]), T4 plug-in hybrid model, with a lease price of € 636 [13] per month, and an emission of 47 g CO2/km.

| 🏠 | 3/5 Work-From-Home |

| 📏 | 12 km work-home distance |

| 🚗 | PHEV car, TCO2 € 833/month |

| 🚴 | € 0.24/km |

The impact of shifting to a bicycle commute mode for two days per week is shown below. As discussed earlier, the bicycle compensation is not set off completely by the decrease in car costs, and we can see a slight increase in the after-tax total cost of mobility (TCM). In terms of CO2-emission, a reduction 24 kg per month results from the modal shift (-18%).

Figure 3: Shift to e-bike – Total cost of mobility, in after tax costs (EUR/month)

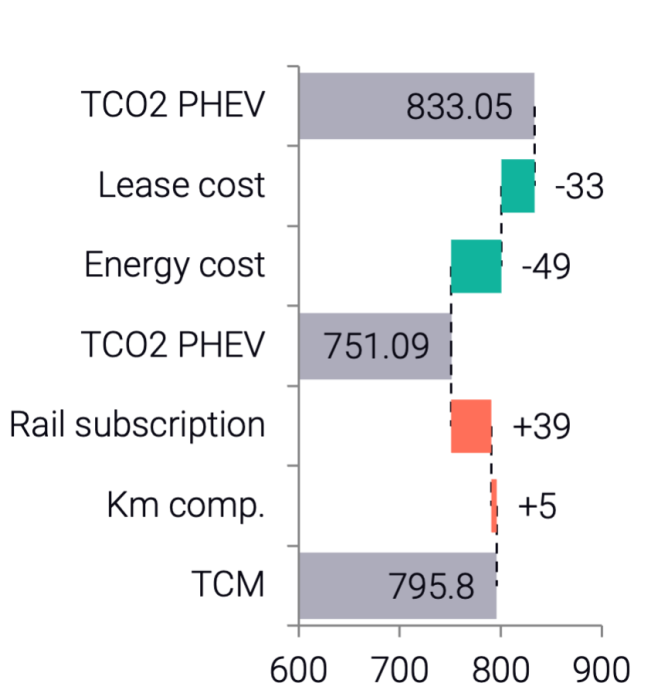

Shift to rail-bike example

In the second example, the same employee now lives 45km for work. Instead of using the car two days per week, she opts to use of a combination of train and bicycle: she walks to the station, takes the train, and bikes the last two kilometres to work.

| 🏠 | 3/5 Work-From-Home |

| 📏 | 45 km work-home distance |

| 🚗 | PHEV car, TCO2 € 833/month |

| 🚴 | € 0.24/km |

| 🚆 | Subscription [14] (40km) |

In analogy with the e-bike example, Figure 4 shows the resulting Total Cost of Mobility, per month. Since a longer trajectory is replaced by an alternative mode, the car savings are more significant, and make up for the kilometer compensation and the rail subscription. Note that in this scenario, a 45% reduction of CO2-emission is obtained, avoiding 62kg of carbon dioxide per month.

Figure 4: Shift to rail-bike – Total cost of mobility, in after tax costs (EUR/month)

Conclusion

Alternative mobility costs are often wrongly considered as additional costs that come “on top” for employers. In fact, if the alternative mobility is used to replace company car kilometres, these costs are directly connected via the total cost of mobility and should therefore be reviewed as such. Paying for additional alternative mobility, on top of the company car, can result in net savings for the employer. More specifically, replacing longer commutes by train, even for a limited number of days per week, appears to be a financially attractive measure. A potential risk, however, is that train subscriptions are a fixed, up-front expenditure, and it does not guarantee that the employee will make use of it as intended, resulting in low savings. Reimbursements for cycling is not a cost-saving operation, but it can potentially unlock the larger commutes that are, via the first- and last mile route legs.

In our work for clients, LIF analyses Total Cost of Mobility bottom-up for all employees. We determines the impact from mobility policies by applying probabilities in terms of modal shift, based on the specific commute characteristics of the employees’ trajectories. If you have any questions about our approach and methodology, or you would like to review mobility policies in your organisation, feel free to contact us.

[1] https://www.rivm.nl/documenten/brochure-gezondheidseffecten-van-reizen-met-auto-of-trein-in-woon-werkverkeer

[2] Hendriksen, Ingrid JM, et al. “The association between commuter cycling and sickness absence.” Preventive medicine 51.2 (2010): 132-135.

[3] Ma, Liang, and Runing Ye. “Does daily commuting behaviour matter to employee productivity?.” Journal of Transport Geography 76 (2019): 130-141. Active travel was associated with 0.4 points out of ten improvement on job performance. The study showed the effect to be significant. The confidence interval around the 0.4 points is about 0.15 to 0.65. Or 1.5% to 6.5%.

[4] https://financien.belgium.be/nl/particulieren/vervoer/aftrek_vervoersonkosten/woon-werkverkeer/fiets#:~:text=De%20fietsvergoeding%20is%20vrijgesteld%20van,die%20volledig%20vrijgesteld%20van%20belastingen.

[5] https://www.partena-professional.be/nl/knowledge-center/infoflashes/pc-200-ontwerp-van-protocolakkoord-2021-2022

[6] If there are no sectoral or specific provisions, it is the Law of 27 July 1962 and the Collective Labour Agreements nos. 19/9 and 19/10 of 23 April and 28 May 2019 that oblige the employer to pay an allowance for the cost of journeys made by the employee using public transport (train, tram, bus, metro). Amounts can be found here: http://www.cnt-nar.be/CAO-ORIG/cao-019-09-(23.04.2019).pdf

[7] https://werk.belgie.be/nl/themas/verloning/tussenkomst-van-de-werkgever-de-verplaatsingskosten-woon-werkverkeer#:~:text=De%20tussenkomst%20van%20de%20werkgever%20is%20verplicht%20wanneer%20de%20afgelegde,9%20van%2023%20april%202019).

[8] https://www.securex.eu/lex-go.nsf/PrintReferences?OpenAgent&Cat2=66~~24&Lang=NL

[9] Assuming PC200 employers

[10] Apart from the physical and mental well-being of the employee, and resulting potential benefits in terms of absenteeism and productivity, as well as reduced carbon emission

[11] https://letitfleet.com/blogs/total-cost-of-ownership/

[12] https://www.fleet.be/de-meest-populaire-bedrijfswagens-van-2021-zijn/#:~:text=Hoewel%20BMW%20drie%20modellen%20in,(ook%20bij%20de%20particulieren).

[13] https://directlease.be/leasing/volvo/xc40/t4-phev-essential-aut/?so=24&yearlyKm=20000&duration=48&winterTires=N&dealerChoice=DL&renting=N

[14] Third-party payer system, if applicable