When an employee can make use of the company car for private kilometres, the employee is taxed on a benefit in kind. This benefit in kind is considered a professional income, and your employer states this benefit on your pay slip 281.10 or 281.20. The employee receiving this benefit will therefore have to pay tax on the amount corresponding to the value of the benefit in kind. What is the impact of the ongoing fleet electrification for employees?

Benefit in kind: what amount?

The taxable benefit is calculated on an annual basis with the following formula:

Benefit in kind = Catalogue value of the vehicle x CO2 coefficient x 6/7 x age coefficient

Catalogue value of the vehicle

By catalogue value, the “fiscal value” is intended. This fiscal value represents the full, non-discounted catalog value of the car, including all selected options, augmented with the VAT effectively paid (including potential purchase discounts).

Age coefficient

With every month started counting as a complete month:

| Period since registration | Age coefficient |

| 0 to 12 months | 1 |

| 13 to 24 months | 0.94 |

| 25 to 36 months | 0.88 |

| 37 to 48 months | 0.82 |

| 49 to 60 months | 0.76 |

| More than 60 months | 0.7 |

It is clear that the benefit in kind decreases over the lifetime of the vehicle: the benefit in kind is higher for new vehicles.

CO2 coefficient

The CO2 coefficient is between 4% and 18%, and is calculated as follows:

[5,5 + ((CO2 – reference emission) x 0,1)] %

For emission-free powertrains (electric, hydrogen) the coefficient is 4%. For fossil fuels, the reference emissions determine the benefit in kind. These are indexed yearly, and as can be seen below, are decreasing rapidly. These causes the benefit in kind for thermal engines the increase heavily for employees.

| Year | Diesel | Petrol |

| 2020 | 91 g/km | 111 g/km |

| 2021 | 84 g/km | 102 g/km |

| 2022 | 75 g/km | 91 g/km |

The CO2 emission used in the formula is the officially reported one (box 49.1 of the certificate of conformity).

Notes on emissions:

- ⚠️ Note that, to avoid giving unjustified tax advantages to high-emitting plug-in hybrids, plug-in hybrids ordered after 01/01/2018 should comply with two conditions in order to use the official emission:

- Not emitting more than 50 g CO2/km per kilometer

- Have a battery that is at least 0.5 kWh for every 100 kg that the vehicle weighs

If one or both conditions are not met, the plug-in is considered a “fake hybrid”, and the emission of the “corresponding vehicle” should be taken, or, if no corresponding vehicle is known, the official emission should be multiplied with 2.5. A list of “false hybrids” and their corresponding non-hybrid vehicle is available on the website of the FOD finances[1].

- ⚠️ For LPG vehicles, the CO2 value to be taken into account is that of the petrol vehicle before the conversion to LPG.

Finally, the benefit in kind cannot be less than the minimum benefit in kind. The minimum benefit in kind is also indexed annually and amounts to € 1400/year in 2022 (€116.67/month). Based on the above formulas, electric vehicles with a catalogue value below €40 833 will be subject to the minimum BIK.

| Year | Minimum BIK |

| 2020 | € 1360/year |

| 2021 | € 1370/year |

| 2022 | € 1400/year |

Net impact for the employee

The average gross wage in Belgium is € 3 758/month[2]. As annual income for such wage exceeds the highest tax bracket (€41 360), which is taxed at 50%[3], an often-used rule of thumb is to divide the BIK by two to arrive at the net cost for the employee. In what follows, a more detailed calculation is used, in the net wage of an employee with and without BIK is compared to arrive at the net BIK cost. For the net wage calculation, the income tax is derived from the official salary scales[4].a. Salary scale 1 is applicable, which is when the recipient of income is a single person or has a spouse or legal cohabitant who has his/her own professional income. Next, also the RSZ of the employee, as well as the special contribution social security[5] is taken into account. Note that more importantly, any employee who has a company car available for private use is be granted a flat-rate exemption of € 430.[6][7] Therefore, the net impact for BIK is lower than 50%.

Examples

In what follows, an elaborated example for four Volkswagens, each with a different motorisation (Diesel[8], Petrol[9], PHEV[10], EV[11]), is provided, in line with our earlier blog. Lease contract parameters are 25,000 annual kilometers, and 48 months duration. In the table below, the description and relevant parameters are depicted, as well as the resulting benefit in kind for 2022. Note the large differences between pure ICE powertrains (Diesel, Petrol) and (plug-in) electric cars. For instance, the net cost of the benefit in kind for the plug-in hybrid currently is only half of the net cost of the benefit in kind for the diesel: € 710 net difference on a yearly basis, or almost €60 per month.

| Powertrain | Model description | Fiscal value | Fiscal emission | Benefit in kind/year | Estimated net cost employee/year |

| Diesel | Golf VIII 2.0 TDI 85kW Life Business Premium | € 41297.30 | 110 g CO2/km | € 3185.79 | € 1417.03 |

| Petrol | Golf VIII 1.5 TSI 96kW Life Business Premium | € 38084.75 | 122 g CO2/km | € 2807.39 | € 1152.83 |

| PHEV | Golf VIII 1.4 eHybrid Style DSG | € 50662.70 | 21 g CO2/km | € 1737.01 | € 707.74 |

| Electric | ID.4 77kWh 128kW Pro | € 56041.15 | 0 g CO2/km | € 1921.41 | € 796.40 |

In line with the ambitions of the Federal Government to have all new vehicles carbon-free as of 2026, the reference emissions for diesel and petrol have been extrapolated from current values to zero in 2026, as follows:

Simulation parameters:

| Year | Diesel | Petrol | Minimum BIK |

| 2020 | 91 g/km | 111 g/km | 1360 |

| 2021 | 84 g/km | 102 g/km | 1370 |

| 2022 | 75 g/km | 91 g/km | 1400 |

| 2023 | 60 g/km | 75 g/km | 1440 |

| 2024 | 40 g/km | 50 g/km | 1490 |

| 2025 | 15 g/km | 20 g/km | 1550 |

| 2026 | 0 g/km | 0 g/km | 1670 |

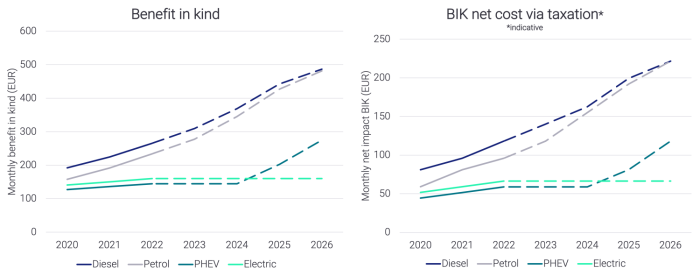

The ongoing benefit in kind trends, as well as the extrapolation towards 2026, is depicted in the figures below. The years in the chart refer to the car being ordered (and delivered) on the first day of the year, and the cost in the same full fiscal year. It is clear that the diverging trend between combustion engines and electric cars will continue, with net cost differences amounting to €150 per month between an employee ordering a diesel versus an electric car in 2026.

Gross and net cost benefit in kind

Conclusion

In our earlier blog[12], we explained the impact of benefit in kind on the after-tax calculations for the employer. As explained above, this part of the car expenses can be considered a salary cost and is therefore 100 % deductible[13]. However, 17% or 40% of these expenses are added to the rejected expenses, depending on whether the employee has a fuel card. In this blog, the (after-tax) impact for the employee was looked into.

It is clear that the ambitions of the federal government are also impactful for the employee: an employee ordering a new company car with an internal combustion engine (diesel or petrol), already pays substantially more taxes because of the benefit in kind, with differences in our example of multiple hundreds of euros per year in net costs. Projecting the differences for upcoming years show differences ranging between €1000 and €2000 per year, or above € 100 net per month.

[1] https://financien.belgium.be/nl/faq/valse-hybrides#q1

[2] https://statbel.fgov.be/nl/themas/werk-opleiding/lonen-en-arbeidskosten/gemiddelde-bruto-maandlonen#:~:text=Gemiddeld%20brutoloon%3A%203.758%20euro%20per%20maand

[3] https://financien.belgium.be/nl/particulieren/belastingaangifte/tarieven-belastbaar-inkomen/tarieven#q1

[4] https://financien.belgium.be/sites/default/files/Schalen%201%20januari%202021%20%28KB%2016%20december%202020%29.pdf

[5] https://www.socialsecurity.be/employer/instructions/dmfa/nl/latest/instructions/special_contributions/other_specialcontributions/specialsocialsecuritycontribution.html

[6] https://overheid.vlaanderen.be/personeel/regelgeving/fiscale-aspecten-van-het-gebruik-van-een-dienstvoertuig#:~:text=Bij%20de%20berekening%20zal%20elk,de%20uiteindelijke%20taxatie%20verrekend%20worden.

[7] https://financien.belgium.be/nl/particulieren/vervoer/aftrek_vervoersonkosten/woon-werkverkeer/forfait_en_werkelijke_kosten

[8] https://directlease.be/leasing/volkswagen/golf-viii/2-0-tdi-85kw-life-business-premium/?yearlyKm=25000&duration=48&winterTires=N&dealerChoice=DL&renting=N

[9] https://directlease.be/leasing/volkswagen/golf-viii/1-5-tsi-96kw-life-business-premium/?yearlyKm=25000&duration=48&winterTires=N&dealerChoice=DL&renting=N

[10] https://directlease.be/leasing/volkswagen/golf-viii/1-4-ehybrid-style-dsg/?yearlyKm=25000&duration=48&winterTires=N&dealerChoice=DL&renting=N

[11] https://directlease.be/leasing/volkswagen/id-4/77kwh-128kw-pro/?yearlyKm=25000&duration=48&winterTires=N&dealerChoice=DL&renting=N

[12] https://letitfleet.com/blogs/total-cost-of-ownership/

[13] https://www.wolterskluwer.com/nl-be/expert-insights/car-expenses-deduction-benefit#:~:text=Geen%20aftrekbeperking%20meer%20van%20autokosten%20ten%20belope%20van%20voordeel%20van%20alle%20aard,-Van%20het%20wetsontwerp&text=gebruiker%20belast%20wordt%20op%20een,het%20voordeel%20van%20de%20belastingplichtige.