A recent article in De Tijd[1] reported that companies, during their electrification efforts, will most likely have to start using a total cost of ownership (TCO) approach, instead of tweaking the current budget methodology. Why the shift to TCO budgeting is essential to evaluate the eligibility of new vehicles in car policies, is explained in detail in this blog on budget bias. However, for those that are not fully aware of what a TCO approach entails, this article provides a brief overview of the different elements, and the before and after-tax version of TCO.

A before-tax total cost: TCO1

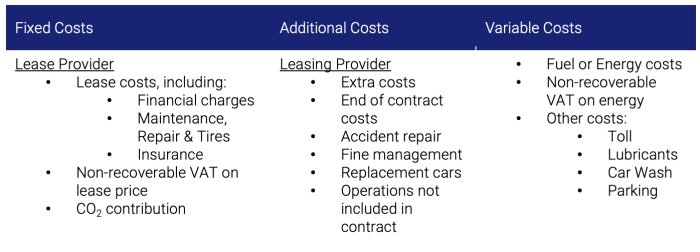

As the name suggests, TCO approaches aim at providing a more comprehensive view on the costs of an asset, by including the operational expenditures (OpEx) on top of the capital expenditures (CapEx). In the context of the corporate lease car, Table 1 provides an exhaustive breakdown of a total costs before tax (henceforth: TCO1).

Table 1: TCO breakdown

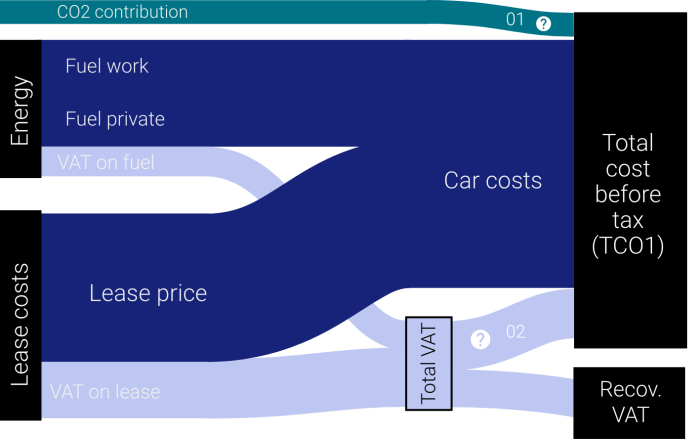

In what follows, the fuel and/or charging costs will be taken into account, as well as non-recoverable VAT and solidarity taxes (CO2 contribution), as depicted in Figure 1.

Figure 1: TCO1 graphical overview

CO2 contribution (01)

The tax benefit resulting from the private use of a company car is not subject to the ordinary social security contributions, but to a special solidarity contribution, which is paid in full by the employer.

For internal combustion engines (ICE) the CO2 contribution is calculated as follows:

((CO2 emission * 9) – a)/12 * b

With:

- CO2 emission: the FOD Finances specified the CO2 emission as follows[2]:

- the NEDC CO2 value when the vehicle only has a NEDC value;

- the WLTP CO2 value when the vehicle only has a WLTP value;

- The NEDC 2.0 CO2 value or the WLTP CO2 value (free choice) when the vehicle has both a NEDC 2.0 value and a WLTP value[3].

- a: fuel-specific term (diesel: 600, petrol: 768, LPG: 900)

- b: indexation coefficient[4] (2021: 1,3525)

For electric vehicles and, in absence of a possible legal amendment, hydrogen cars, the CO2 tax is equal to the minimum amount of (20.83 x 1.3525) = € 28.17 per month.

Non-recoverable VAT (02)

The VAT on car expenses is recoverable to the extent that the car is used professionally, but with a maximum of 50%. Three methods are accepted by the fiscal administration to determine the rate of VAT deduction:

- Determine proportion of business use by trip administration

- Semi-flat rate method for private use: non-deductible VAT portion = ((home to work distance x 2 x 200 working days) + 6,000 private kilometres) x100, to be divided by the total number of kilometres driven

- Flat rate professional use of 35 %

After-tax costing: TCO2

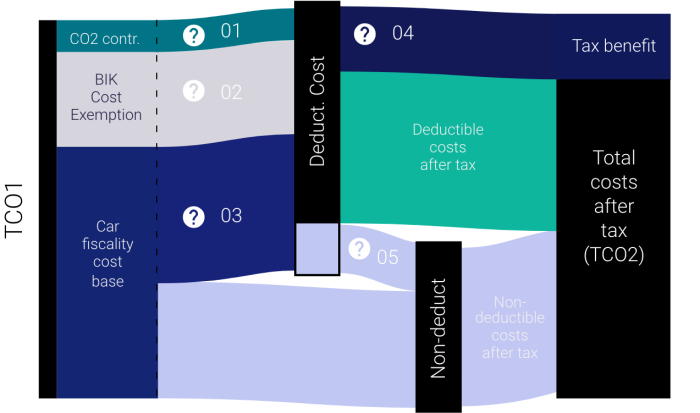

The TCO1 approach does not consider the fiscal deductibility of these corporate expenses. For the Belgian situation, part of the company car costs is deductible in tax calculations. Figure 2 provides a schematical overview of the TCO2 calculation method, along with the reference numbers:

- CO2 contribution: fully deductible (01)

- Car expenses amounting to the Benefit in Kind are exempt from the reduced fiscality cost rate, and thus fully deductible (02)

- Part of the car expenses eligible for deduction, determined by fiscality rate (03)

- Rejected expenses (05)

Figure 2: TCO2 graphical overview

Benefit in Kind Cost Exemption (02)

When the employee can make use of the company car for private kilometres, the employee is taxed on a benefit in kind. To the extent of that benefit, the deduction limitation for car expenses does not apply. After all, to that extent the expenses can be considered as a salary cost and no longer as a real car cost. This part of the car expenses is therefore 100 % deductible[5]. A detailed overview of Benefit in Kind, and the impact of electrification for both employee and employer, will be provided in an upcoming blog.

Fiscality rate (03)

As from fiscal year 2020, the tax deduction percentage is determined, per car, based on the the so-called “gram formula”.[6]

120% – (0.5%× coefficient × fiscal emission)

With:

- coefficient:

- 1 for cars with a diesel engine

- 90 for cars with a natural gas engine (cng) less than 12 fiscal horsepower

- 95 for all other cars, i.e. cars with a petrol engine and electric cars

- fiscal emission:

- In line with the section on CO2 contribution, the CO2 emission as specified by the FOD Finances should be used

Note that, to avoid giving unjustified tax advantages to high-emitting plug-in hybrids, plug-in hybrids ordered after 01/01/2018 should comply with two conditions in order to use the official emission:

- Not emitting more than 50 g CO2/km per kilometer

- Have a battery that is at least 0.5 kWh for every 100 kg that the vehicle weighs

If one or both conditions are not met, the plug-in is considered a “fake hybrid”, and the emission of the “corresponding vehicle” should be taken, or, if no corresponding vehicle is known, the official emission should be multiplied with 2.5. A list of “false hybrids” and their corresponding non-hybrid vehicle is available on the website of the FOD finances [7].

Rejected expenses (05)

Depending on the employee having a fuel card for private use, 17% or 40% of the amount Benefit in Kind should be subtracted from the deductible costs and considered non-deductible.

Tax benefit (04)

Provided the company is making a profit, the corporate tax rate (25%) of deductible car expenses, i.e. the amount of reduced taxes on profit, is obtained as a tax benefit. Reducing the TCO1 with the tax benefit results in TCO2, the total costs after tax.

Example

Consider a typical junior company car with fuel card: Mercedes-Benz A-Klasse – A 180 Business Line:

| Mercedes-Benz A180 BL[8] | |

| Fuel type | Petrol |

| Monthly lease costs (ex. VAT) | € 567[9] |

| Catalogue value | € 36,179 |

| CO22 emission | 135gr |

| Energy consumption | 5.9 l/100km |

Monthly results TCO1:

| Mercedes-Benz A180 BL | |

| Energy costs (ex. VAT)[11] | € 190.30 |

| CO2 contribution[12] | € 50.38 |

| Non-recoverable VAT[13] | € 103.37 |

| TCO1 | € 911.06 |

Monthly results TCO2:

| Mercedes-Benz A180 BL | |

| Benefit in Kind (BIK) | € 309.56 |

| BIK rejected expenses | € 123.83 |

| Fiscality rate | 55.875% |

| Tax benefit | € 136.02 |

| TCO2 | € 775.04 |

Outlook

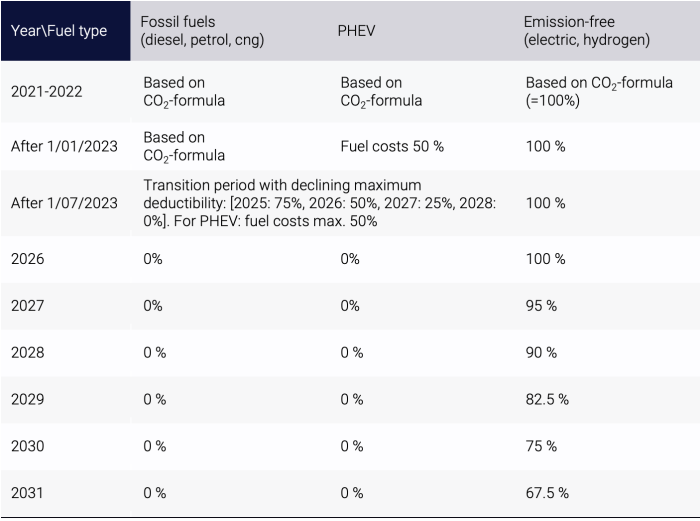

In 2021, the Federal Government announced its ambition to have a completely emission-free Belgian company car park by 2030. Effective January 1, 2022, the new regulation ends, as from 2026 onwards, the tax benefits for all cars emitting CO2 : petrols, diesels and hybrids. Only fully electric cars will keep their favourable regime. An overview of the new regulation is provided in Table 2. For more details, the reader is referred to the official law publication[15] or the Circulaire 2021/C/115 on fiscal greening of mobility.[16]

Table 2: Changing fiscality

A second important part of the strategy to have a completely emission-free Belgian company car park by 2030, is to substantially increase the CO2 contribution for emitting cars.

The calculated contribution must be multiplied by a factor of 2.25 from 1 July 2023, by a factor of 2.75 from 1 January 2025, by a factor of 4.00 from 1 January 2026 and by a factor of 5.50 from 1 January 2027.

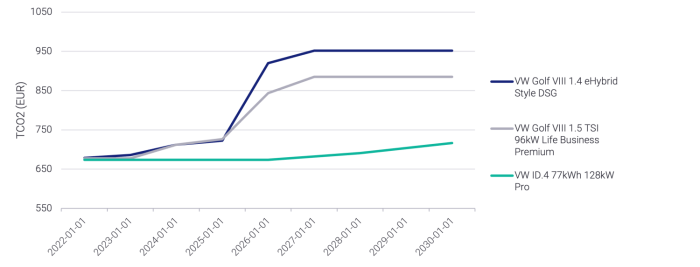

In what follows, an elaborated example for three Volkswagens, each with a different motorization (ICE, PHEV, EV), is provided. Lease contract parameters are 25,000 annual kilometers, and 48 months duration. The year in the top row refers to the car being ordered (and delivered) on the first day of the year, and the cost in the same full fiscal year. For both models of Volkswagen Golf VIII, a fierce increase in CO2 contribution, and hence TCO1, can be seen as from 2024. Furthermore, both models are no longer fiscally deductible as from 2026. Also note the first uptick for the PHEV fuel costs in 2023, as deduction rate falls to 50% to encourage electric use of the PHEV.

Volkswagen Golf VIII, 1.5 TSI 96kW Life Business Premium, monthly lease price € 503[17]

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| CO2 contribution | 37.19 | 37.19 | 83.69 | 102.28 | 148.78 | 204.57 | 204.57 |

| TCO1 | 804.31 | 804.31 | 850.80 | 869.40 | 915.89 | 971.68 | 971.68 |

| Fiscality rate | 0.62 | 0.62 | 0.62 | 0.62 | 0.00 | 0.00 | 0.00 |

| Variable cost AT | 158.47 | 158.47 | 158.47 | 158.47 | 177.91 | 177.91 | 177.91 |

| TCO2 | 677.21 | 677.21 | 712.08 | 726.03 | 843.60 | 885.44 | 885.44 |

Volkswagen Golf VIII,1.4 eHybrid Style DSG, monthly lease price € 644[18]

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| CO2 contribution | 28.17 | 28.17 | 63.38 | 77.47 | 112.68 | 154.94 | 154.94 |

| TCO1 | 885.50 | 885.50 | 920.71 | 934.80 | 970.01 | 1012.27 | 1012.27 |

| Fiscality rate | 1.00 | 1.00 | 1.00 | 1.00 | 0.00 | 0.00 | 0.00 |

| Variable cost AT | 94.06 | 101.39 | 101.39 | 101.39 | 114.56 | 114.56 | 114.56 |

| TCO2 | 685.92 | 685.92 | 712.33 | 722.90 | 920.13 | 951.82 | 951.82 |

Volkswagen ID.4 77kWh 128kW Pro, monthly lease price € 640[19]

| 2023 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | |

| CO2 contribution | 28.17 | 28.17 | 28.17 | 28.17 | 28.17 | 28.17 | 28.17 |

| TCO1 | 876.71 | 876.71 | 876.71 | 876.71 | 876.71 | 876.71 | 876.71 |

| Fiscality rate | 1.00 | 1.00 | 1.00 | 1.00 | 0.95 | 0.90 | 0.83 |

| Variable cost AT | 90.88 | 90.88 | 90.88 | 90.88 | 91.80 | 92.71 | 94.08 |

| TCO2 | 673.54 | 673.54 | 673.54 | 673.54 | 682.15 | 690.75 | 703.66 |

Figure 3 shows the graphical result for the after-tax total costs. Whereas the three vehicles have a comparable after-tax cost to the employer today, monthly surplus cost for the Golf VIII hybrid car evolves to over € 200 by 2026, compared to the ID.4.

Figure 3: Evolution of Total Cost of Ownership after Tax

For questions, more information, or help on calculating the TCO of your fleet, do not hesitate to contact us at info@letitfleet.com

References

[1] https://www.tijd.be/ondernemen/auto/bedrijven-schakelen-om-naar-elektrische-leasewagens/10349399

[2] https://financien.belgium.be/sites/default/files/downloads/121-faq-bedrijfswagens-2021-20210224.pdf

[3] For more information on the new fuel consumption and emission test procedures: https://www.wltpfacts.eu/what-is-wltp-how-will-it-work/

[4] https://overheid.vlaanderen.be/personeel/regelgeving/fiscale-aspecten-van-het-gebruik-van-een-dienstvoertuig#voetnoot_10

[5] https://www.wolterskluwer.com/nl-be/expert-insights/car-expenses-deduction-benefit#:~:text=Geen%20aftrekbeperking%20meer%20van%20autokosten%20ten%20belope%20van%20voordeel%20van%20alle%20aard,-Van%20het%20wetsontwerp&text=gebruiker%20belast%20wordt%20op%20een,het%20voordeel%20van%20de%20belastingplichtige.

[6] http://www.ejustice.just.fgov.be/cgi/article_body.pl?language=nl&caller=summary&pub_date=17-12-29&numac=2017014414

[7] https://financien.belgium.be/nl/faq/valse-hybrides#q1

[8] https://directlease.be/leasing/mercedes-benz/a-klasse/a-180-business-line/?yearlyKm=25000&duration=48&winterTires=N&dealerChoice=DL&renting=N

[9] For 48 months, and 25,000 annual kilometers

[10] https://directlease.be/leasing/mercedes-benz/a-klasse/a-180-business-line/?yearlyKm=25000&duration=48&winterTires=N&dealerChoice=DL&renting=N

[11] Corrections apply, in line with Tietge U., Díaz S., Mock P., Bandivadekar A., Dornoff J., Ligterink D., “FROM LABORATORY TO ROAD, A 2018 UPDATE OF OFFICIAL AND “REAL-WORLD” FUEL CONSUMPTION AND CO2 VALUES FOR PASSENGER CARS IN EUROPE”, January 2019

[12] https://overheid.vlaanderen.be/personeel/regelgeving/fiscale-aspecten-van-het-gebruik-van-een-dienstvoertuig

[13] The default flat rate of 35%, as accepted by fiscus, is used to determine the recoverable VAT.

[15] http://www.ejustice.just.fgov.be/mopdf/2021/12/03_1.pdf

[16] https://eservices.minfin.fgov.be/myminfin-web/pages/fisconet/document/0f0f25d2-4bdd-42b3-914e-57883a218f6e#_1._Autofiscaliteit

[17] https://directlease.be/leasing/volkswagen/golf-viii/1-5-tsi-96kw-life-business-premium/?yearlyKm=25000&duration=48&winterTires=N&dealerChoice=DL&renting=N

[18] https://directlease.be/leasing/volkswagen/golf-viii/1-4-ehybrid-style-dsg/?yearlyKm=25000&duration=48&winterTires=N&dealerChoice=DL&renting=N

[19] https://directlease.be/leasing/volkswagen/id-4/77kwh-128kw-pro/?yearlyKm=25000&duration=48&winterTires=N&dealerChoice=DL&renting=N